sales tax in fulton county ga 2019

A tax sale is the sale of a Tax Lien by a governmental entity for unpaid property taxes by the propertys owner. This includes a four percent statewide sales tax one percent MARTA tax one percent education tax one percent local option tax and 75 TSPLOST tax.

Georgia S Internet Retail Tax Takes Effect Jan 1

Fulton County sales tax.

. A county-wide sales tax rate of 26 is applicable. Other possible tax rates in Georgia include. General Rate Chart - Effective April 1 2022 through June 30.

Has impacted many state nexus laws and. The 2018 United States Supreme Court decision in South Dakota v. This is the total of state and county sales tax rates.

3 rows Fulton County. Find your Georgia combined state and local tax rate. Due to renovations at the Fulton County Courthouse.

Fulton County Sales. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am.

A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER. Bidders must register each month for the Tax Sale. For TDDTTY or Georgia Relay Access.

SW TG500 Atlanta GA 30303 to receive their total amount due to Fulton County Sheriffs Office. The December 2020 total local sales tax rate was also 8900. Sales Tax Breakdown Atlanta Details Atlanta GA is in Fulton County.

Helpful Links Cities of Fulton County. Atlanta is in the following zip codes. Georgia sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

The current total local sales tax rate in Atlanta GA is 8900. 30301 30302 30303. Any entity that conducts business within Georgia may be required to register for one or more tax specific identification numbers permits andor licenses.

The base state sales tax rate in Georgia is 4. Georgia state sales tax. State and local sales tax rates as of January 1 2019.

The total 775 Fulton County sales tax rate is only applicable to businesses and sellers that are not in the Greater Atlanta area. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. The change was largely due to a 1 percent sales tax in Broward County and a 15 percentage-point local increase.

For sales of motor vehicles that are subject to sales and use tax Georgia law provides for limited exemptions from certain local taxes. Georgia has a lot of different counties 159 in total and has the second-largest number of counties in the US with only Texas having more 254 counties. Interactive Tax Map Unlimited Use.

If your business is based in Atlanta or you sell to customers in Atlanta then the sales tax rate is 49. Inside the City of Atlanta in both DeKalb County and Fulton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate. The Fulton County Sheriffs Office month of November 2019 tax sales.

18 rows The Fulton County Sales Tax is 26. The Georgia state sales tax rate is currently. The Fulton County sales tax rate is.

Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next. Fulton County in Georgia has a tax rate of 775 for 2022 this includes the Georgia Sales Tax Rate of 4 and Local Sales Tax Rates in Fulton County totaling 375. The Georgia sales tax rate for most counties is 3-4 which means that most counties when combined with Georgias sales tax rate are in the 7-8 range.

Check out our new state tax map to see how high 2019 sales tax rates are in your state. 2019 through March 31 2019 28935 KB General Rate Chart - Effective October 1 2018 through December 31 2018 28959 KB Department of. The current total local sales tax rate in Fulton.

Sales Tax Rates - General. What are the Georgia state rates for 2019. Surplus Real Estate for Sale.

GA Sales Tax Rate. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next. Depending on local municipalities the total tax rate can be as high as 9.

Winning Bidder- Upon the conclusion of the Tax Sale the winning bidder will come back within 1 hour to 185 Central Ave. Georgia Tax Center Help Individual Income Taxes Register New Business. Local tax rates in Georgia range from 0 to 5 making the sales tax range in Georgia 4 to 9.

Furthermore economic nexus may be triggered. Sales Tax States shows that the lowest tax rate in Georgia is found in Austell and is 4. Winning Bidder must pay by 4 pm on the 1 st Tuesday of the month.

This coupled with the base rate of Georgia sales tax means the effective rate is 89. If you need reasonable accommodations due to a disability including communications in an alternative format please contact the Disability Compliance Liaison at 404612-9166. Georgia State Sales Tax.

The 1 MOST does not apply to sales of motor vehicles. The Georgia GA state sales tax rate is currently 4. Sales Tax Fulton Countys sales tax is 775 percent collected on all retail sales except food.

ICalculator US Excellent Free Online Calculators for Personal and Business use. Ad Lookup Sales Tax Rates For Free. State and local sales tax rates as of January 1 2019.

Atlanta GA 30303 404-612-4000 customerservicefultoncountygagov.

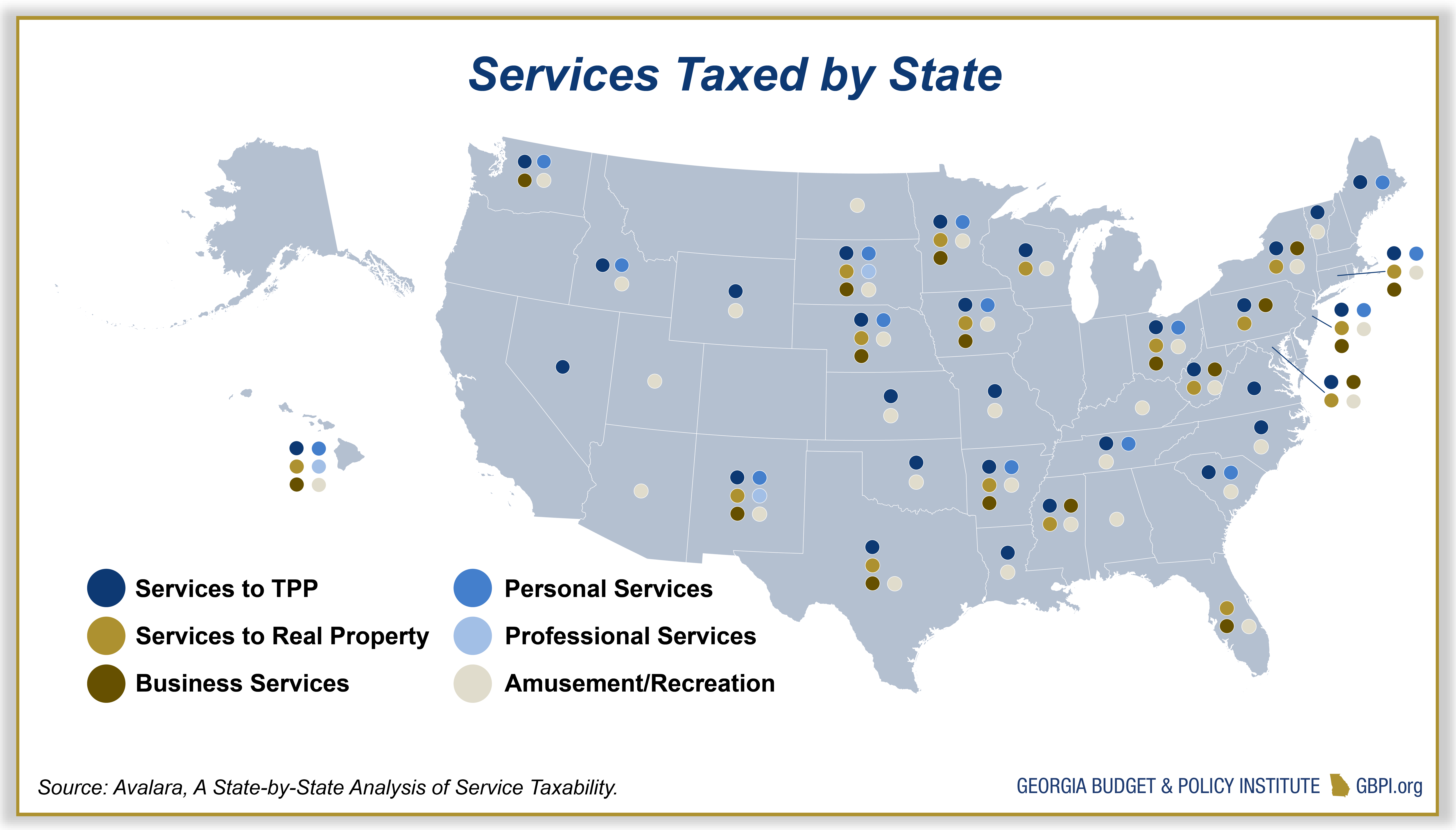

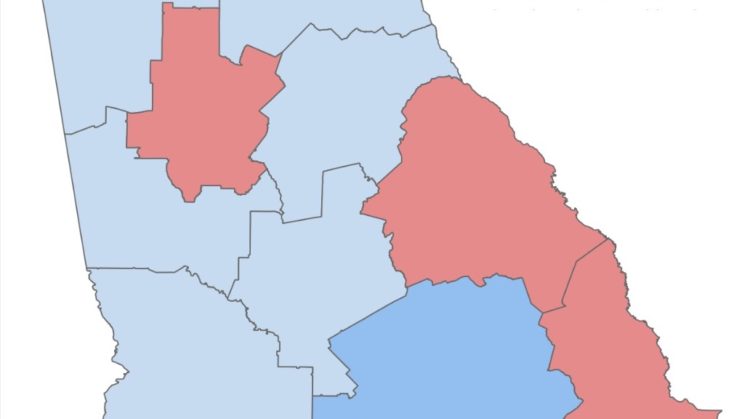

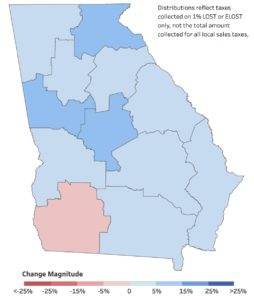

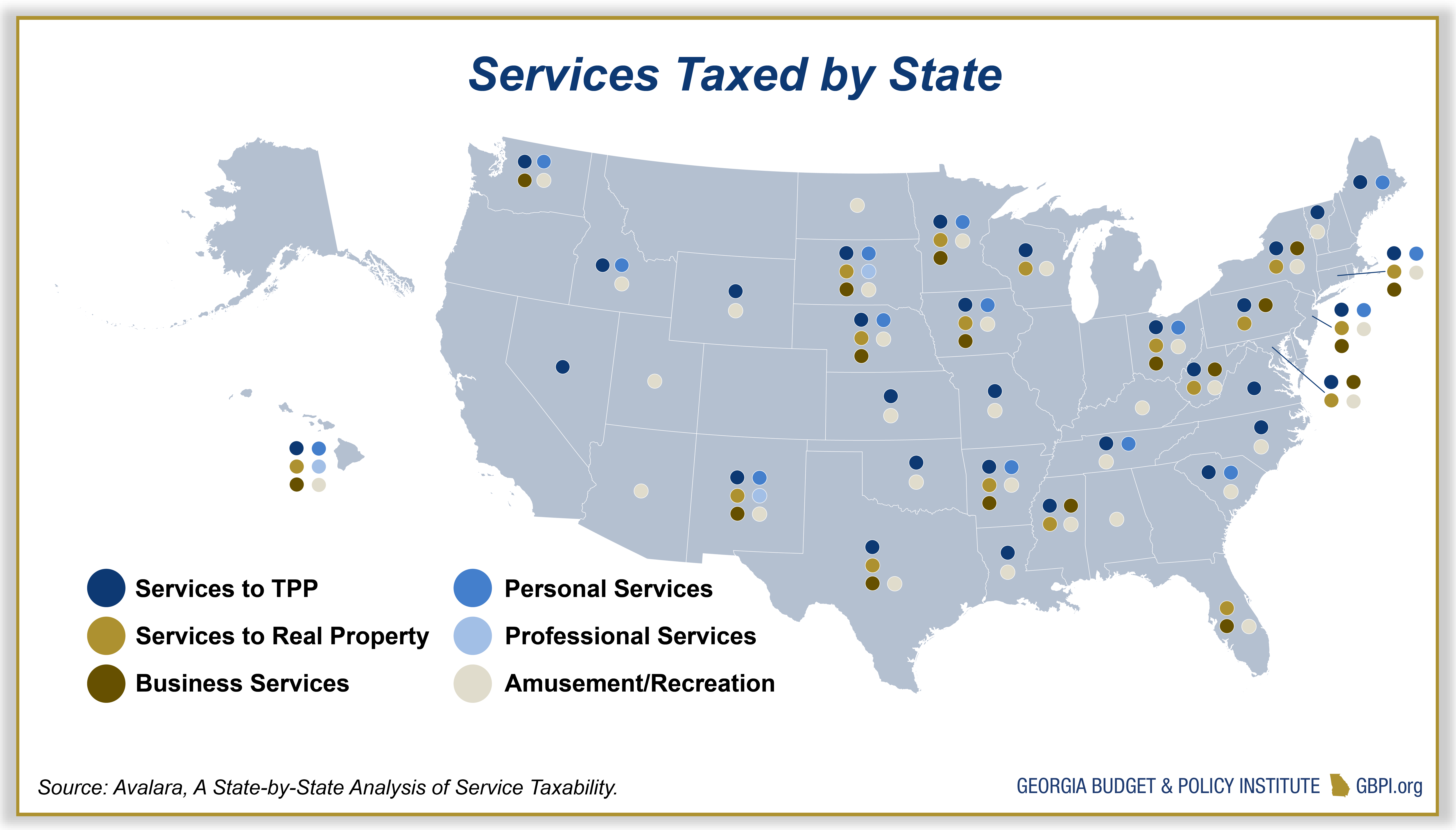

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Atlanta Georgia S Sales Tax Rate Is 8 5

Classic Tax Service Home Facebook

Sales Tax Collections Plummet At Least 15 In Metro Atlanta In June New Gsu Research Tool Saportareport

How To Register For A Sales Tax Permit In Georgia Taxvalet

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

Sales Tax Collections Plummet At Least 15 In Metro Atlanta In June New Gsu Research Tool Saportareport

W Val Oveson Joins Taxometry As Senior Vice President Send2press Newswire New Technology Paradigm Shift State Tax

Georgia Used Car Sales Tax Fees

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Office Of Contract Compliance Atlanta Ga

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Solid Waste Charges Billing Atlanta Ga

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute